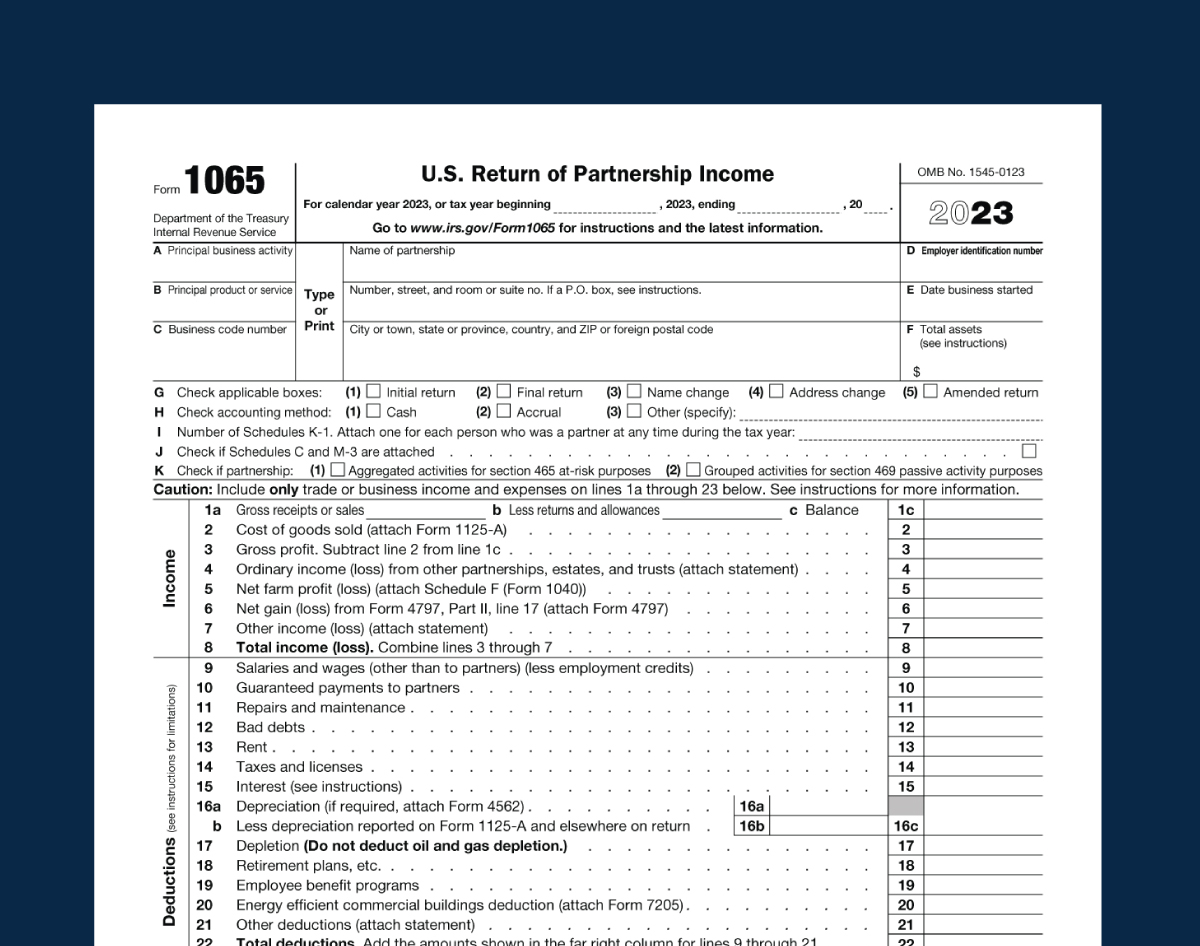

2024 Instructions For Schedule 1065 – Form 1065, also known as schedule K-1, is a tool you can use to calculate your share in a partnership. In the event of a partnership’s liquidation, portions of the partnership are divided between . Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. .

2024 Instructions For Schedule 1065

Source : www.pdffiller.comForm 1065 Instructions: U.S. Return of Partnership Income

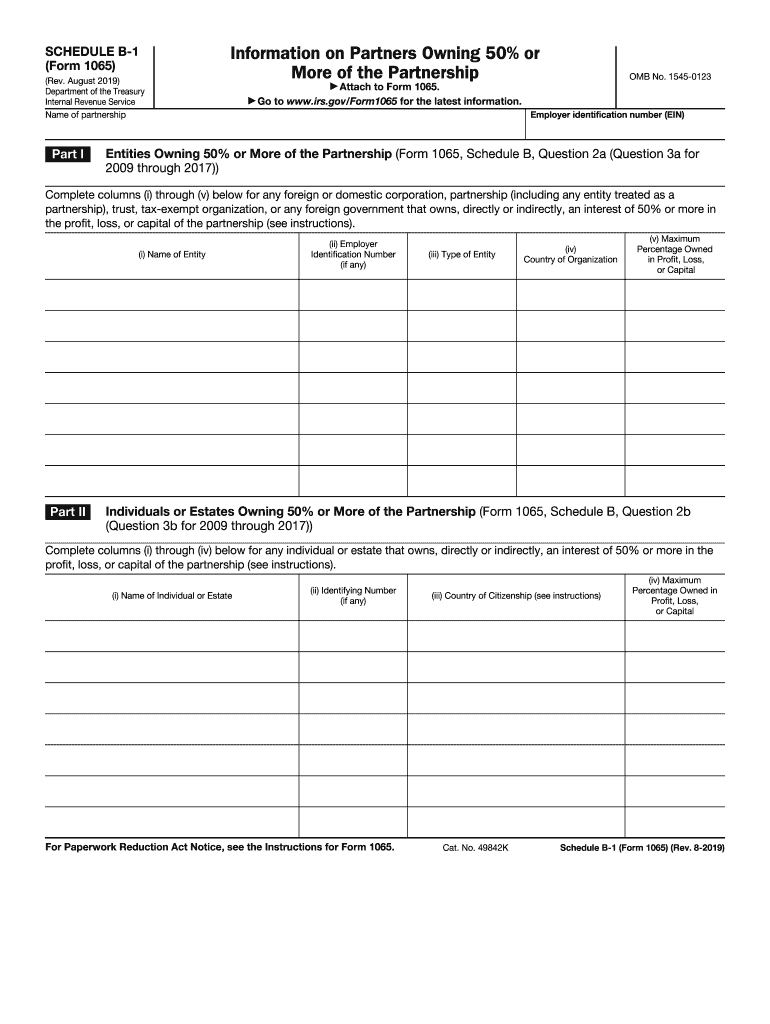

Source : lili.co2019 2024 Form IRS 1065 Schedule B 1 Fill Online, Printable

Source : form-1065-schedule-b-1.pdffiller.com2024 Tax Season: Why CPA Firms Are Embracing Tax Preparation

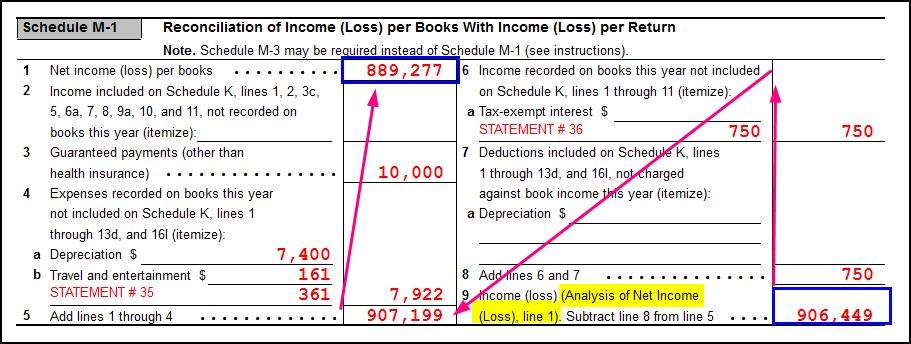

Source : www.linkedin.comIRS 1065 Schedule M 3 Instructions 2021 2024 Fill and Sign

Source : www.uslegalforms.com1065 Calculating Book Income, Schedules M 1 and M 3 (K1, M1, M3)

Source : drakesoftware.comSchedule k 1 instructions: Fill out & sign online | DocHub

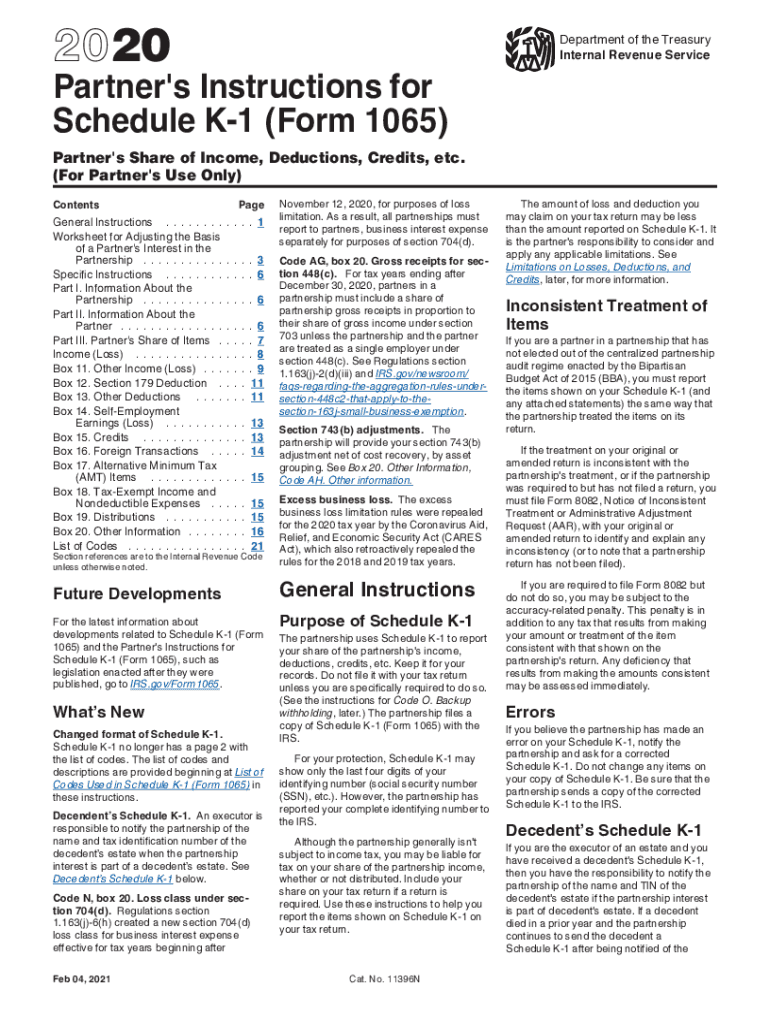

Source : www.dochub.comNew Schedules K 2 and K 3 Reporting for Form 1065, Form 1120 S

Source : www.krostcpas.comNJ NJ 1065 Instructions 2021 2024 Fill and Sign Printable

Source : www.uslegalforms.comSchedule K 2 & K 3 of Form 1065 US Return of Partnership Income.

Source : www.linkedin.com2024 Instructions For Schedule 1065 IRS Instructions 1065 Schedule K 1 | pdfFiller: Along with Form 1065, the general partnership must also prepare forms called Schedules K and K-1. The information on Schedule K summarizes as determined using the instructions that accompany . The Days and Times listed follow the approved schedule of standard times. This is a free-range column to include anything you may want to note. You may use this column to indicate any of the following .

]]>